New state law could freeze real estate taxes for some Missourians, school districts and others say they’d lose money annually

ST. CHARLES, Mo. (First Alert 4) – A new state law could help your pocketbook — but potentially hurt the quality of your local school and fire department.

Senate Bill 3 was aimed at funding the Kansas City Chiefs and Royals stadium projects, but inside the bill is a measure allowing for the freezing of property taxes in some Missouri counties.

St. Charles, Jefferson and Franklin counties are on the list.

“Our home ownership is part of the American Dream,” said GOP lawmaker Joe Nicola.

Nicola, who argued in favor of a property tax freeze in the special session in June. And it worked. Lawmakers passed a major tax bill, also aiming to fund Kansas City sports stadiums.

On Monday, the St. Charles County Council passed a bill putting the tax freeze question on the April 2026 ballot. The state law requires counties like St. Charles to put the question to voters, asking if they want to freeze their real estate taxes in the form of a tax credit. Jefferson and Franklin county voters will likely face a similar ballot question.

“Something that sounds great, may not be great,” said St. Charles County Collector of Revenue Michelle McBride.

McBride says while St. Charles County will take a small hit, smaller Missouri counties will feel a squeeze.

“They would have nothing to fund their public services,” said McBride.

School districts are also worried.

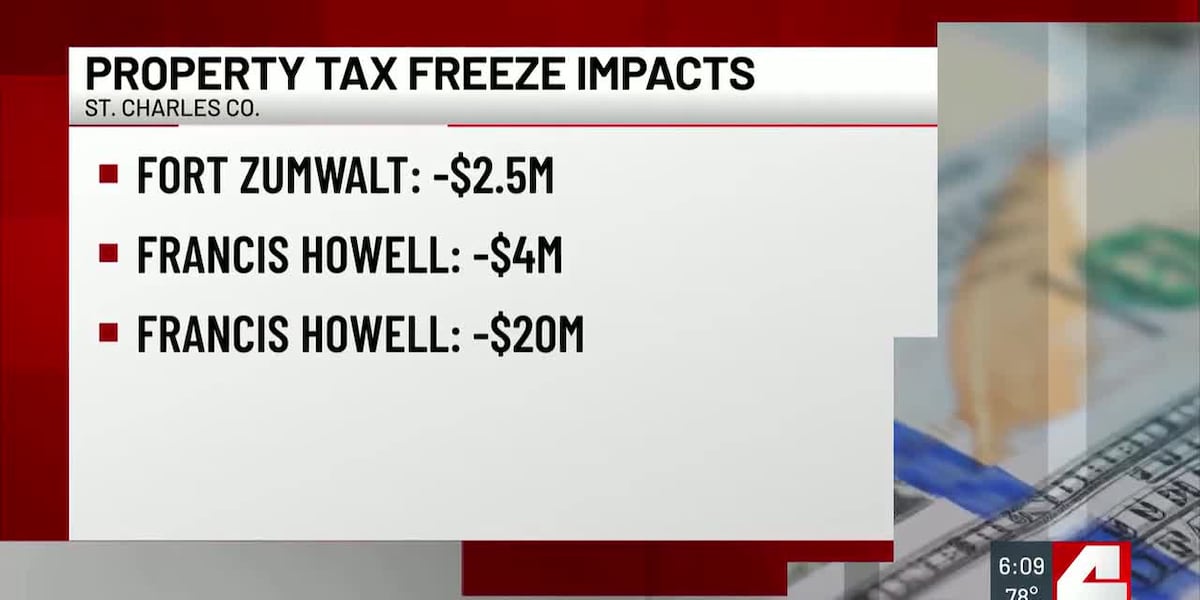

Fort Zumwalt District Superintendent Henry St. Pierre projects losing $2.5 million for the 2026-27 school year. In the same time period, Francis Howell projects a $4 million shortfall. And in five years, Francis Howell expects to be in the red by $20 million.

“Class sizes will likely go up, which could mean the quality of education for the children goes down,” said McBride.

Fire and ambulance districts would also get pinched. If taxes froze, the St. Charles County Ambulance District projects the one-year impact around $1.6 million. The shortfall over 10 years could top $30 million.

And on the other side of the state, in Marshfield, Missouri, Fire Chief Michael Taylor is frank about the impact.

“Cannot survive as an organization and receive no additional funding,” said Taylor.

Multiple area school districts, including the City of St. Charles School District, have voted to sue the state, saying the law is unconstitutional. Still, no lawsuit has been filed yet.

Still, plenty are in favor, including St. Charles County Executive Steve Ehlmann, saying people have demanded this and deserve a tax break.

But the bill does not include St. Louis City or St. Louis County, which Ehlmann said it should.

“But not only the people in St. Charles, Jefferson, Warren & Lincoln Counties, I think the people in St. Louis City and County deserve a chance too,” said Ehlmann.

.

Copyright 2025 KMOV. All rights reserved.

link