U.S. Property Management Services Market Report, 2033

U.S. Property Management Services Market Summary

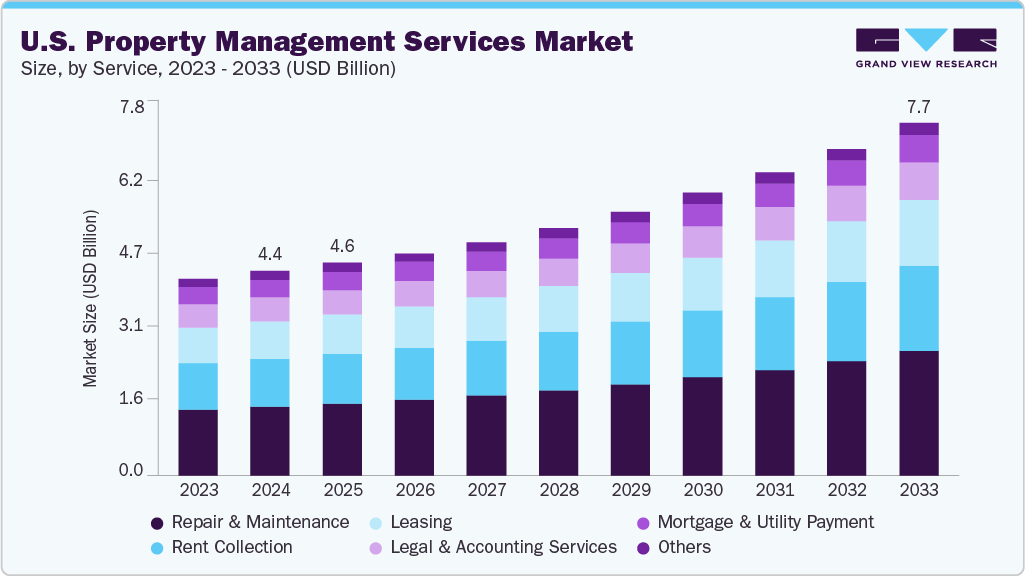

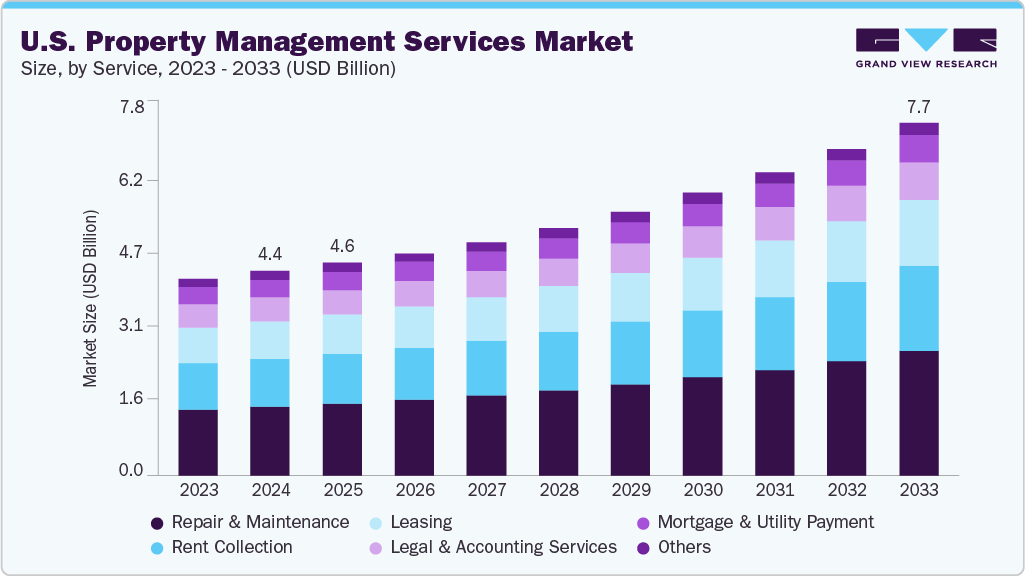

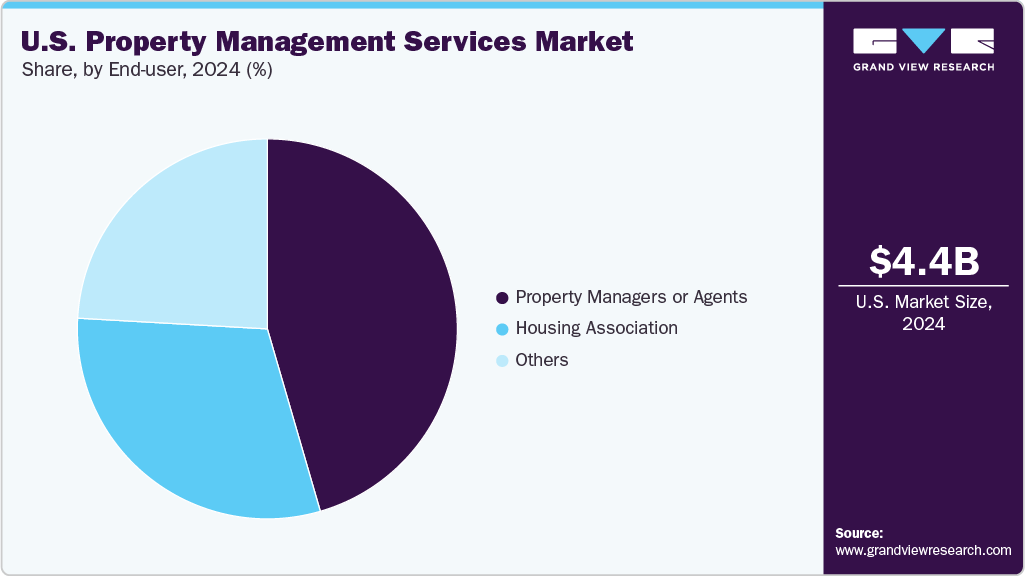

The U.S. property management services market size was estimated at USD 4,426.8 million in 2024 and is expected to reach at USD 7,660.8 million by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The market is driven by rising rental demand, rapid urban development, and the growing adoption of digital technologies.

Key Market Trends & Insights

- The U.S. property management services market is expected to grow at a CAGR of 6.6% over the forecast period.

- By service, rent collection segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

- By property type, commercial segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

- By end user, housing association segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4,426.8 Million

- 2033 Projected Market Size: USD 7,660.8 Million

- CAGR (2025-2033): 6.6%

Improved operational efficiency and a strong shift toward professional management solutions are further accelerating market growth across residential and commercial sectors. In the U.S., the rise of smart buildings and the use of data analytics for predictive maintenance and leasing strategies are key drivers of market growth. Evolving tenant expectations especially for responsive service and seamless digital experiences are also pushing property management firms to innovate and stay competitive.

Market Concentration & Characteristics

The U.S. property management services market is moderately fragmented, characterized by the presence of a few large national players such as Greystar, CBRE, and FirstService Residential alongside numerous small to mid-sized regional firms. While major companies dominate high-density urban areas and manage large-scale commercial and multifamily portfolios, local and regional firms maintain a strong foothold in residential and suburban markets, where personalized service and local expertise are valued. The market is witnessing a gradual trend toward consolidation, driven by mergers and acquisitions, as larger firms aim to expand their geographic presence, scale operations, and integrate advanced property management technologies.

The U.S. property management services market exhibits a strong emphasis on innovation, primarily fueled by the rapid adoption of PropTech (Property Technology) solutions. Companies are increasingly integrating AI-powered tools, IoT-enabled maintenance systems, mobile applications, and cloud-based platforms to streamline operations, enhance tenant engagement, and improve overall service delivery. These technologies enable predictive maintenance, automate rent collection and leasing processes, and provide real-time insights for data-driven decision-making. As tenant expectations evolve and operational efficiency becomes a competitive differentiator, the role of PropTech is becoming central to modern property management strategies in the U.S.

Mergers and acquisitions are on the rise in the U.S. property management services market, as large firms pursue regional acquisitions to expand their geographic footprint and diversify service offerings. This consolidation trend is driven by the need for greater operational scale, streamlined technology adoption, and access to a broad mix of residential and commercial properties.

Regulations play a pivotal role in the U.S. property management services market, particularly in areas such as tenant rights, fair housing laws, data privacy, and property maintenance standards. Since regulatory frameworks vary significantly by state and municipality, firms must stay informed and adapt operations to remain compliant.

Drivers, Opportunities & Restraints

In the U.S., the property management services market is being driven by the enforcement of compliance standards in key areas such as tenant rights, fair housing, data protection, and maintenance regulations. With state and municipal laws differing widely, firms must stay updated and adjust operations accordingly. The growing emphasis on ESG compliance and energy efficiency mandates is encouraging property managers to implement sustainable practices.

The integration of PropTech presents a significant opportunity for U.S. property management companies. Advanced technologies such as AI-powered analytics, smart home automation, virtual leasing tools, and cloud-based management platforms enable firms to enhance tenant experiences and streamline operational processes.

Varying state and local regulations pose a major challenge for U.S. property management firms. Navigating shifting legal frameworks including rent control laws, eviction procedures, tenant protection policies, and licensing requirements adds complexity to day-to-day operations. Non-compliance can result in legal consequences and reputational harm.

Service Insights

Repair & maintenance segment dominated the market in 2024, accounting for the largest revenue share at 33.5%. This growth is driven by the rising demand for well-maintained, safe, and code-compliant properties. Aging infrastructure across many U.S. cities, increasing tenant expectations for quality living conditions, and stricter local building codes are contributing to steady demand for ongoing repair and maintenance services.

The rent collection segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue, fueled by the increasing use of digital payment platforms and automation tools. Property managers are adopting mobile applications, online portals, and automated reminders to streamline rent collection, minimize payment delays, and improve cash flow management. These technologies are enhancing convenience for tenants and efficiency for property managers, driving adoption across both residential and commercial sectors.

Property Type Insights

Residential dominated the market in 2024, accounting for the largest revenue share at 59.7% fueled by rising rental housing demand, expanding urban populations, and heightened investor interest in multi-family housing. Property owners are increasingly relying on professional managers for tenant screening, rent collection, and maintenance services, driving steady innovation and expansion in residential property management offerings.

The commercial segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue, due to demand for professional management of office buildings, retail centers, and industrial properties. Businesses increasingly seek expert lease management, maintenance, and regulatory compliance services, while investors prioritize outsourcing property management to maximize asset value, enhance tenant retention, and improve operational efficiency.

End-user Insights

The property managers or agents segment dominated the North America property management services market in 2024, holding the largest revenue share at 45.5% driven by increasing demand for specialized, outsourced services across both residential and commercial sectors. As property portfolios grow, managers are adopting digital tools to streamline operations, enhance tenant communication, and ensure compliance with regulations, fueling the shift toward professional property management services.

The housing association and medical segment is expected to grow at a fastest CAGR of 7.0% from 2025 to 2033 in terms of revenue in the North American property management services market, as these organizations increasingly seek professional management to handle maintenance, rent collection, and regulatory compliance efficiently. Growing affordable housing initiatives and government support are driving demand for structured property management solutions, encouraging housing associations to implement scalable, technology-driven services that improve tenant satisfaction and asset performance.

U.S. Property Management Services Company Insights

Some of the key players operating in the market include Greystar, FirstService Residential, Lincoln Property Company, Asset Living.

-

Greystar is a prominent property management company in the U.S., managing a broad portfolio of multifamily, student, and senior housing units. It offers integrated services including property operations, development, and investment management. The company operates across global markets with a strong focus on technology and resident experience.

-

FirstService Residential manages a wide range of residential communities across the U.S. and Canada, including condominiums, homeowner associations, and master-planned developments. The company provides property maintenance, financial services, and administrative support, with an emphasis on enhancing community living, ensuring compliance, and delivering tailored management solutions to property owners and boards.

Key U.S. Property Management Services Companies:

- Greystar

- Lincoln Property

- Asset Living

- FPI

- Alliance Residential

- FirstService Residential

- Evernest

- Darwin Homes

- HomeRiver Group

- Northpoint

Recent Developments

-

In May 2025, Lincoln Property Company expanded its property management services in Southern California through a strategic investment in Unire Real Estate Group. This move strengthens its regional presence, enhances service capabilities, and supports growth in the competitive Southern California real estate market.

-

In February 2024, Asset Living launched a centralized business intelligence platform that enhances overall operations by improving property performance and optimizing business growth. This technology-driven approach enables better decision-making, increases efficiency, and supports the company’s goal of delivering improved services to clients and residents.

U.S. Property Management Services Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 4,603.7 million

|

|

Revenue forecast in 2033

|

USD 7,660.8 million

|

|

Growth rate

|

CAGR of 6.6% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 – 2023

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Service, prodouct type, end-user

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Greystar; Lincoln Property; Asset Living; FPI Management; Alliance Residential; FirstService Residential; Evernest; Darwin Homes; HomeRiver Group; Northpoint

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Property Management Services Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the U.S. property management services market report based on product type, service, and end-user.

-

Service Outlook (Revenue, USD Million, 2021 – 2033)

-

Property Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Residential

-

Commercial

-

Industrial

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2021 – 2033)

Frequently Asked Questions About This Report

b. The U.S. property management services market size was estimated at USD 4,426.8 million in 2024 and is expected to reach USD 4,603.7 million in 2025.

b. The U.S. property management services market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 7,660.8 million by 2033.

b. Repair & maintenance dominated the market in 2024, accounting for the highest revenue share at 33.5%. This growth is driven by the rising demand for well-maintained, safe, and code-compliant properties.

b. Some of the key players operating in the U.S. property management services market include Greystar, Lincoln Property, Asset Living, FPI Management, Alliance Residential, FirstService Residential, Evernest, Darwin Homes, HomeRiver Group, Northpoint.

b. The U.S. property management services market is driven by rising rental demand, rapid urbanization, and increasing real estate investments. The growing need for professional management to handle complex operations, compliance with evolving regulations, and enhanced tenant expectations also fuel growth.

link